The State of Craft Brewing 2024: Is the Glass Half Empty?

Craft Beer Conference

Craft beer’s meteoric boom years may have stalled out, judging from a mild downturn in overall production. 2023 saw a 1% dip in beer production volume. The sector, composed of small and independent breweries, faces continued challenges. While 495 new craft breweries opened in 2023, 418 of the total 9,906 closed, the Brewers Association reports.

The Bad News

Dr. Bart Watson at the Craft Brewers Conference

A major attraction at the annual Craft Brewers Conference is the State of the Industry presentation by the Brewers Association’s chief economist, Dr. Bart Watson. This year Watson was put in the unenviable position of telling a Vegas conference ballroom full of small business people that the volume of craft beer they collectively brewed had diminished, and that the 2022 numbers had been revised to show this downturn is actually a continued trend, now in its second consecutive post-pandemic year.

Watson attempted to give context to relieve the somber messages of his charts. The overall beer industry, including massive brands such as Anheuser-Busch, Molson-Coors and Heineken, suffered a larger 5.1% dip in production volume. In many ways, the smaller, independent craft brewers can adopt the mantle of scrappy survivors. Within their ranks, 44% still saw production growth last year, deftly navigating the “challenging” environment, as Watson describes it.

Capacity Greater than Production

Rapid Adoption & Incremental Growth

On average, brewers are now producing 51% of the capacity their equipment can handle. For decades, breweries have made investments in the largest brewhouses and fermentation vessels they could afford so they would have room to ramp up production as demand for their beers grew. Now stainless steel tanks are sitting empty more frequently. For the majority of craft brewers whose growth has been down or stagnant for two years, a logical move has been to expand into producing other beverages, including seeking licenses for wine or spirits production.

Where is Demand?

However, it is a challenge to find the desired additional demand in those categories, as total beverage alcohol sales are down as well. There are currently over 37,000 active federal TTB permits for producing beer, wine or spirits. “That’s a lot of competition, not just for drinkers, but for retailers and distributors,” Watson noted.

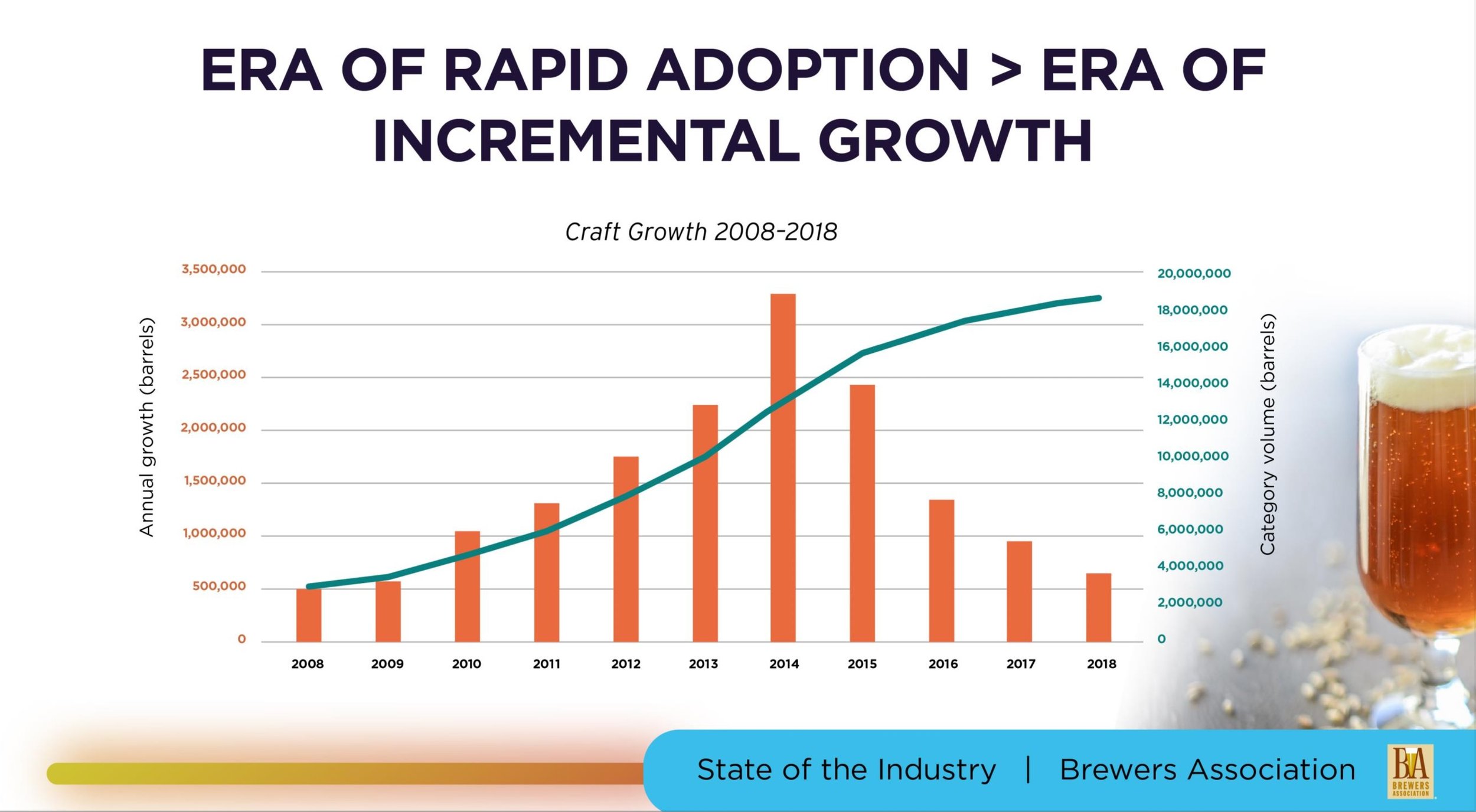

Watson recapped Craft Beer’s spectacular growth up until 2018, showing a bar graph of a maturing marketplace with an S-curve he described as “textbook,” reaching a natural limitation of growth as interested people discovered craft products and the top of the steep curve leveled off.

Costs Going Up, Prices Lagging

Almost every cost that goes into making beer has gone up significantly in recent years while Craft Beer prices have lagged, providing some relief for customers but squeezing brewers even further.

Stepping aside from his statistical briefing for a moment, Watson cited the growing demonization of moderate alcohol consumption as a compounding challenge for brewers.

“I’ll pause and say that alcohol is a social lubricant that makes people happy to go out,” he said. “And in an era where we put the word 'social' in front of media more than it’s used to talk about going out, I think we can all see places in society where we could appreciate the call to sit down and share a beer together.”

The Good News

After showing multiple disturbing trend lines, Watson reassured the brewers that there is good news.

The 2023 closure rate represents about 4% of craft breweries, a much smaller portion than closings in the hospitality industry at large, which is seeing closures at around 10%.

Watson urged breweries to remember that increasing the number of drinkers of Craft Beer is not the only engine for sales growth. It is also possible for breweries to look to drinkers who have craft beer occasionally and to provide them additional attractive occasions and environments for enjoying a beer.

He remarked that brewers are showing more sophistication in how they understand growth, measuring commercial success in dollars instead of barrels brewed. Breweries can find growth in various smart practices such as looking for additional efficiencies on the business side, taking a hard look at distribution profitability and refreshing the experiential elements of on-premise hospitality to keep their customers returning.

After the intense atmosphere of the slide presentation, brewers in the conference hall looked resolute. Several told this reporter that they were “not surprised,” and were already working on the initiatives he had suggested.

Reactions from a Brewery

No-Li Brewhouse in Spokane, Washington

Cole Bryant, Vice President of Business Operations at No-Li Brewhouse in Spokane, Washington, confirmed the perception that the stats and graphs reflect the on-the-ground experience of a more mature market for craft brewers. He reflected that competition has been increasing for years, but success in craft beer can be measured in different forms. There are other goals to consider, such as “serving the underrepresented groups in our community,” Bryant said, via an email.

No-Li Brewhouse takes beer quality seriously, enters blind judged competitions (taking 8 medals at the 2023 New York International Beer Competition) and collaborates with their fellow craft brewers. As Watson noted in his address, making good beers is now “table stakes” for success.

“Even though No-Li has increased production volume every year of our existence,” Bryant continued, “this is a secondary goal to truly building a great craft beer community.” And that is truly a sentiment that the industry as a whole should embrace.