RTDs on the Rise in 2024

To understand the growth of the RTD category, look no further than White Claw, a brand created in 2016 that has grown to become the fourth-largest brewing company in the United States. In less than 10 years, the entire category has exploded and today consumers face an ever-increasing glut of colorful cans and bottles on every store shelf.

The Growth of RTDs

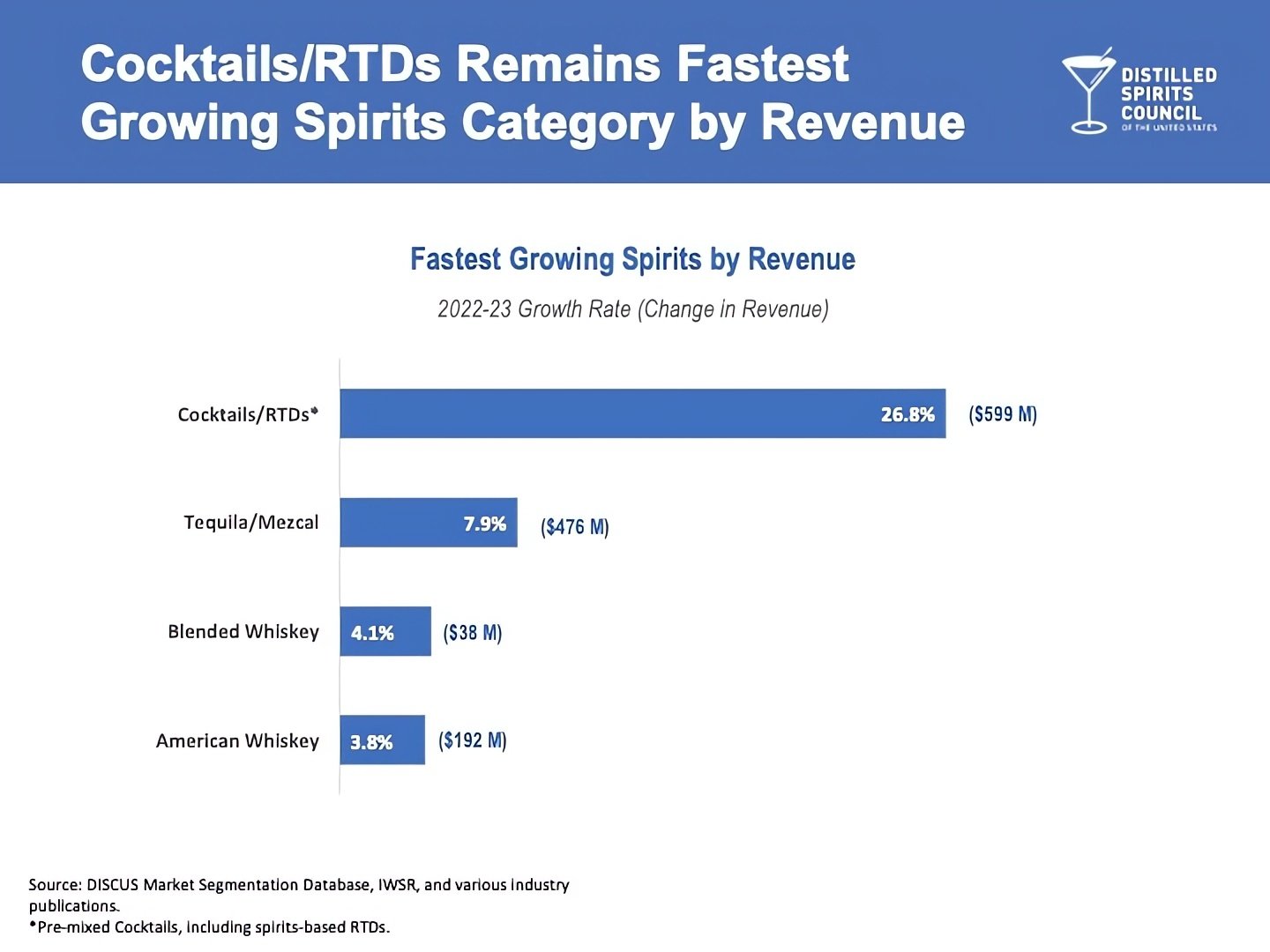

The numbers are head-spinning. According to Drinks Business, “the [RTD] category is predicted to be worth US$21.1 billion in sales by 2027, making it one of the fastest-growing sectors in the spirits industry, with a compound annual growth rate of almost 15%.”

Which SKU’s will ride the tide in this ocean of spritzes and coolers and hard coffees and which will unceremoniously drown?

According to research firm Circana, it’s Gen Z consumers who are leading the charge in the beverage alcohol market, propelling innovation in flavor, packaging, and product formats. Despite a slight softening in sales, their findings suggest that RTDs remain popular across different age groups and household income cohorts. They also report that the RTD category has more than tripled in the US since 2018, reaching $10.3 billion in sales in 2023.

How does a potential beverage innovator hitch a ride with these mind-blowing predictions, and the existence of a clearly defined customer? It’s all about the marketing.

Marketing RTDs

Gustavo Aguirre the VP of Brand Innovation at leading adult beverage PE firm InvestBev, runs the firm’s accelerator program, Sprout Beverage reports, “Companies or brands that are capable of delivering or clearly articulating why they exist and why consumers should be choosing them…are the ones that are going to be successful. Because the ones that say ‘oh, [we have a] great tasting product and just buy me’ that is not gonna happen.”

The phenomenal success of Liquid Death water is an example of the power of marketing versus relying on the can contents. “It was just pure marketing that managed to deliver relevancy to a certain cohort of consumers that suddenly exploded, says Aguirre. “If you think about Liquid Death, it’s just water. So it’s not about the flavor or the taste or the ingredients. It’s about how you make me really feel in order that I connect with your brand in a very distinctive way.” That customer connection leads to customer adoption and ultimately, success.

Which categories will grow?

We’ve all heard about Gen Z’s predilection for N/A and low-alcohol beverages, and their desire for the perceived “better for you” drinks, and the market abounds with examples. But how is that experience different from reaching for a can of pop?

Curious Elixirs

Curious Elixirs offers a broad selection of nonalcoholic drinks that walk the cocktail walk, from spritzes made from non-alcoholic prosecco infused with ginseng, and turmeric, and a tiki inspired booze-free painkiller with coconut and aloe in multiple formats. Low ABV spritzes and flavored waters come in every flavor imaginable and CBD and THC infused drinks present an entirely new frontier for innovation.

Premiumization

El Jimador Spiked Bebidas

The big names in the beverage industry are betting on the success of their well-groomed brands extending into RTD cans and bottles. Shelves are spilling over with products like Lipton Hard Tea, Jack Daniel’s Country Cocktails, SKYY Vodka Sodas, El Jimador Spiked Bebidas, and Ketel One Cosmos, hoping to cash in on the shift from malt based to spirit based offerings.

“Despite the hard seltzer craze we witnessed from 2017 to 2021 which was malt-driven, spirits-based products have actually grown faster, just off a smaller base,” shared Marten Lodewijks, Head of Consulting-Americas at the DISCUS Economic Briefing in February 2024. “Spirits-based products, including the vodka- and tequila-based hard seltzers that entered the picture later, offer consumers a slightly more premium experience, and that has been key to their success over the malt-based alternatives that initially created the category.”

Grown Folks’ hard seltzers

As for those struggling hard seltzers–is creative, targeted market segmentation the answer? Several companies have tailored their offerings to smaller market shares, like Grown Folks, which calls itself “the first hard seltzer built from Louisiana Creole vibes and soul food-inspired flavors.” Their sweet, creamy, soda-pop lineup of flavors includes an homage to ambrosia, that Cool Whip bound pineapple coconut salad found on many family tables especially in the American South.

Similarly, Modelo USA launched their Spiked Aguas Frescas in traditional Mexican flavors like flor de jamaica to appeal to the massive Latin American market. Aguirre calls this “culture forward” messaging, and finds it quite a powerful tool. “If you deliver something that is…in tune with [a particular group’s] flavor expectation and the flavor profile, they will get behind it, and they will definitely amplify the message to everybody they know.”

Every Size

Togronis single serve classic cocktails

At this stage of the game, beverage producers offer small and large format and every format in-between. We’ve seen Togronis single serve classic cocktails in single serve cans, boozy punches in adult juice boxes and multi-serve mimosas in 750 ml bottles. We’ve heard the term ready to pour, ready to serve, ready to shake, ready to sip and we’re ready to consume it all, at home or on a boat or at picnic or a concert, for any occasion. Aguirre sees huge potential opportunity in offering cocktails in portable packaging similar to that of boxed wine “something multi-serve, that is easy to carry, and convenient, to fit with a drinking occasion like barbecues or friendly get-togethers for the younger demographic.”